In her foreword to this year’s Review of Maritime Transport 2025 report, UNCTAD secretary-general writes as follows:

“Global maritime transport has entered uncharted waters.

Not since the closure of the Suez Canal in 1967 have we witnessed such sustained disruption to the arteries of global commerce. Ships that once transited the Red Sea in days now sail for weeks around the Cape of Good Hope. Freight rates that were relatively stable for years now swing wildly from month to month. Supply chains we thought were resilient have proven fragile.

But this is not simply a story of disruption. As this year’s Review of Maritime Transport documents, it is a story of transitions – technological, environmental, geoeconomic – converging at a speed that demands fundamentally rethinking how maritime transport operates.

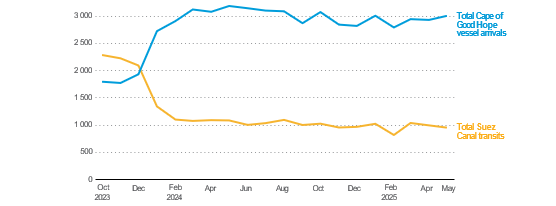

Consider what we face today. The Suez Canal operates below normal capacity, at around 70 per cent below average tonnage transit levels in 2023. This year’s developments around the Strait of Hormuz – a passage for about 34 per cent of global seaborne exports of oil – have drawn renewed attention to the need for sustained dialogue on maritime security. Disruption to port operations has also become chronic, not episodic.

These factors are already reshaping maritime trade patterns. While flows continued to expand by 2.2 per cent in 2024 over 2023, they have done so at a moderate pace – below the average recorded over the 20 years from 2003 to 2023. More telling still: maritime trade now travels significantly longer distances, with the average voyage haul having increased from 4,831 miles in 2018, to 5,245 miles in 2024, as security concerns redraw the map of global shipping. Seaborne trade in ton- miles increased by 5.9 per cent in 2024 on 2023, close to three times the increase in the volume of maritime trade. Distance is no longer geography; it is geoeconomics. Yet alongside these immediate pressures, deeper shifts are reshaping the sector. The Netzero Framework of the International Maritime Organization, set to be considered for adoption in October 2025, could reshape even further how ships are built, fuelled and operated. The orderbooks already tell this story: alternative fuel vessels now represent more than half of the ship tonnage of new orders, though over 90 per cent of the active fleet by tonnage still runs on conventional fuels. This gap between ambition and reality defines our challenge.

Meanwhile, automation and digitalization advances at breathtaking pace. Smart ports often process containers in minutes, not hours. Artificial intelligence systems predict congestion before it happens. Autonomous vessels are starting to move from concept to prototype. But each digital advance creates new vulnerabilities – cyberattacks on shipping are also on the rise. We are building tomorrow’s infrastructure on today’s security and regulatory foundations. Who bears these costs? Developing countries now budget for freight costs that can change more in a week than they once did in a year. Small island developing States watch their import bills soar while their export competitiveness erodes. Landlocked developing countries sometimes pay transport costs three times the global average – and see that gap widen with each disruption. This cannot be our future.

The transitions ahead – to zero carbon, to digital systems, to new trade routes – must be just transitions. They must empower, not exclude. They must build resilience, not deepen vulnerability. And they must recognize that maritime transport is not merely ships and cargo; it is 1.9 million seafarers, most of whom come from developing countries and whose skills need updating, whose rights need protection, whose contribution needs recognition. UNCTAD stands ready to support this shift. Through research that illuminates, technical cooperation that builds capacity and consensus-building that brings all voices to the table at the global, regional and national levels, we work to ensure that these transitions leave no one behind.

This Review offers more than data and analysis. It offers a framework for action. Sustainable and resilient practices that can withstand tomorrow’s shocks. Regulatory updates that match the new technological reality and sustainability standards. Decarbonization pathways that are both ambitious and achievable. Investment in people, not just infrastructure. Trade facilitation that turns borders from barriers, into gateways.

Maritime transport has weathered disruptions before – wars, closures, economic crises. But never have so many transitions converged so quickly. The sector will adapt; it always does. The question is whether that adaptation will be managed or chaotic, inclusive or divisive, sustainable or merely survivable. This Review of Maritime Transport provides the evidence base for choosing wisely. The work begins now.”

The United Nations Conference on Trade and Development (UNCTAD) has published its detailed Review of Maritime Transport 2025 report, in which it explores the global maritime trade environment that has been particularly marked by volatility, rerouted flows and uncertainty.

According to the report, maritime trade volumes reached 12,720 million tons in 2024, growing by 2.2 per cent, exceeding the 2013–2023 average (1.8 per cent). This suggests positive momentum, yet the growth rate lagged the 2003–2023 average (2.9 per cent), indicating a longer-term deceleration in the expansion of global volume. However, in 2025, global maritime trade continues to navigate an environment marked by volatility, rerouted flows and uncertainty.

“Not since the closure of the Suez Canal in 1967 have we witnessed such sustained disruption to the arteries of global commerce,” said Rebeca Grynspan, Secretary-General of UN Trade and Development (UNCTAD).

Key highlights made in the report:

- In 2025, global maritime trade is operating in a volatile and uncertain environment, with shipping routes increasingly rerouted.

- Persistent geopolitical tensions and trade policy changes have altered shipping patterns, with many routes redirected away from traditional chokepoints.

- Containerized trade is expanding, especially along extra regional corridors.

- East–West routes remain dominant, anchored by Asia’s central role in global logistics.

- Supply chains are increasingly diversified, with more complex origin and destination networks emerging to manage rising uncertainty.

- Energy-related trade is undergoing a structural transformation.

- Longer hauls and redirected flows are affecting tanker demand.

- Trade in critical minerals, vital to clean energy transitions, remains concentrated in a handful of exporters.

- This concentration heightens exposure to strategic and logistical chokepoints.

GEOPOLITICAL TENSIONS AND DISRUPTED MARITIME CHOKEPOINTS

In 2024 and the first half of 2025, global shipping grappled with rapidly shifting operating conditions driven by trade policy shifts and tariffs, geopolitical tensions, ongoing disruption to critical shipping routes, intensified pressure on the shipping industry to decarbonize and a restructuring in global container shipping alliances.

In addition, the sector faces strengthened environmental sustainability targets and regulations, advances in technology, fleet renewal needs, and continued uncertainty over the decarbonization and energy transition.

New ship capacity continues to be delivered, especially in the container segment, while trade growth in some markets has slowed. This is reviving some concerns about a potential fleet capacity surplus and asset underutilization when distance-adjusted demand, which had absorbed surplus capacity over the past few years, eventually normalizes. Ongoing uncertainty around navigation in the Red Sea has led to shipping avoiding the Suez Canal, with transit levels about 70% below 2023 averages as of May 2025. This has increased distance-adjusted demand due to rerouting around the Cape of Good Hope, which may ease if geopolitical tensions subside.

The June 2025 conflict between Iran and Israel raised concerns over disruptions at the Strait of Hormuz, a vital chokepoint handling 11% of global maritime trade volume, including significant oil, LPG exports, and container traffic near Jebel Ali port.

Although no immediate shipping disruptions were seen by late June, risks remain high due to limited alternative routes and insufficient pipeline capacity. Potential changes in sourcing could increase voyage distances, costs, and fleet needs, with longer transit times possibly trapping ships and tightening supply in the region.

TRADE POLICY, TARIFFS AND PORT FEES

Since January 2025, new trade tariffs and shifts in U.S. trade policy have increased volatility and uncertainty in global shipping. These changes could significantly impact shipping demand, fleet capacity, networks, and port operations, depending on responses from other countries. Similar to the 2018 U.S.-China tariff escalation, countries like Canada, India, Mexico, Thailand, and Vietnam benefited from rerouted trade flows, reflecting global value chain reconfigurations.

Despite these shifts, China remained the main source of scheduled container capacity in 2025. Additionally, the U.S. is pursuing a domestic-focused industrial policy to boost national shipbuilding and maritime transport, including new port fees targeting certain ships to counter China’s dominance in global maritime logistics and shipbuilding.

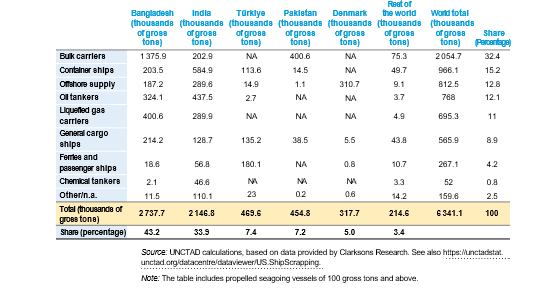

SHIP RECYCLING LEVELS TOUCHED HISTORIC LOW

Ship recycling levels remained low in 2024, matching 2023’s 6.3 million gross tons or 0.25% of the global fleet, with bulk carriers making up the largest share of scrapped tonnage. Recycling is expected to stay subdued short-term but may recover as market conditions improve, second-hand prices drop, and fleet modernization accelerates amid an aging fleet. Bangladesh, India, Pakistan, and Türkiye dominated the market, accounting for over 91% of recycling, with Bangladesh and India leading. Limited recycling capacity in these countries, combined with increasing deliveries and aging ships, poses challenges for supply-demand balance and timely fleet renewal.

Furthermore, environmental regulations are tightening, highlighted by the Hong Kong Convention for safe, sustainable ship recycling, which came into force in June 2025.

SHIPPING CARBON EMISSIONS CONTINUED TO GROW IN 2024

The International Maritime Organization midterm greenhouse gas reduction measures were agreed in 2025; their formal adoption may be imminent. Carbon emissions from shipping increased by an estimated 5 per cent in 2024 over 2023 driven by continued ship rerouting and increased speeds.

In the first half of 2025, a reduction in emissions was observed, probably reflecting slower sailing speeds, some operational improvements and the deployment of new ships. Vessel speed trends were mixed. Average container ship speeds increased, especially in the largest sizes as vessels sailed faster to maintain service schedules.

LNG carrier speeds also climbed in 2024 owing to disruption in key maritime chokepoints. For other vessel segments, speed generally remained steady or declined. In early 2025, speeds softened across fleet segments, with younger and more efficient ships running at slightly faster speeds compared to older units.

At the same time, the regulatory push for decarbonizing shipping continues. The IMO Marine Environment Protection Committee approved new midterm greenhouse gas reduction measures at its eighty-third session in April 2025.

The measures combine mandatory fuel intensity limits and a greenhouse gas pricing mechanism. They will be considered for adoption at an extraordinary session of the Committee in October 2025 before entering into force in March 2027, with a 1 January 2028 date of implementation.

While it is too early to assess the outcomes, the new measures would likely help to increase the supply of alternative fuels and lower their prices, both of which remain key hurdles to uptake. Revenues to be collected would provide rewards to ships for greenhouse gas emissions avoided by using zero- or near-zero emissions energy sources.

“The Net-Zero Framework of the International Maritime Organization, set to be considered for adoption in October 2025, could reshape even further how ships are built, fuelled and operated. The orderbooks already tell this story: alternative fuel vessels now represent more than half of the ship tonnage of new orders, though over 90 per cent of the active fleet by tonnage still runs on conventional fuels. This gap between ambition and reality defines our challenge,” said Rebeca Grynspan.

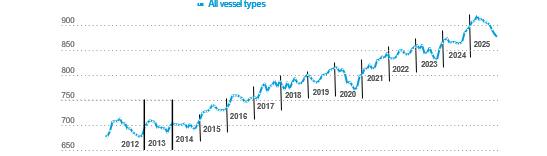

THE GLOBAL FLEET CONTINUES TO AGE DESPITE NEW SHIP DELIVERIES AND ORDERS

Weighted by gross tonnage, the global fleet was, on average, 12.6 years old in 2024, a 3.2 per cent increase over 2023. By vessel count, the fleet was 22.2 years old or 1.8 per cent older than a year earlier. In 2024, the fleet was more than three years older than it was a decade ago.

Developing countries’ share of dead weight ton capacity that is older than 20 years (21.1 per cent) was more than twice that of developed economies (9.3 per cent). Set against the current moderate orderbook measured as a proportion of the global active fleet and significantly low ship recycling levels, the pace at which the ageing fleet will be replaced remains uncertain.

POLICY UNCERTAINTY AND CONTINUED DISRUPTION WEIGH ON THE GLOBAL TRADE OUTLOOK IN 2025 AND BEYOND

The outlook for global seaborne trade in 2025 is increasingly complex and marked by downside risks. Continued policy volatility, geopolitical tensions (including Red Sea insecurity, the war in Ukraine, and tensions in the Middle East), and softer macroeconomic conditions are weighing on confidence and demand. As a result, both merchandise trade and maritime transport activity are projected to slow, with the outlook shifting markedly since early 2025.

The global trade outlook for 2025 remains fragile, shaped by persistent policy uncertainty, subdued private consumption, and deteriorating investor sentiment. While global GDP growth is projected at 3%, merchandise trade is expected to rise only 0.1%, recovering from earlier contraction forecasts.

Temporary tariff pauses and early-year shipment surges have offered limited support, but renewed tariff measures and weak demand, especially from China, weigh heavily on trade flows.

Seaborne trade projections were revised down to 0.5% growth, with containerized trade expected to grow by 1.4%. Distance-adjusted volumes are set to rise just 0.3%, reflecting earlier rerouting effects. Fleet overcapacity, soft macroeconomic conditions, and structural shifts continue to suppress growth prospects.

Download the Review of Maritime Transport 2025 Report: 949